Easily Build an Effective LinkedIn Profile

Generate leads through a proven process, without paying!

LinkedIn is a Social Media outlet with many unique advantages for Financial Advisors.

If you are looking for higher user engagement scores, increased organic reach, targeted filters, recommendations, etc., LinkedIn brings significant value.

The average LinkedIn user’s income is over $109,000 per year, with a strong Baby Boomer user demographic. Other groups such as Millennials and Gen X are also using LinkedIn to network, find new clients, and gain relevant new education and information.

We all need to ask ourselves: Are we leveraging LinkedIn to better communicate with our Clients, Prospects, Centers of Influence and Referral Sources?

12 Simple Steps - Easily Build an Effective LinkedIn Profile:

Begin with the basics

Add photos

Have a well written summary

Describe your experiences

Add relevant skills

Recommendations

Education

Start building a network

Groups and Hobbies

Post content

Keep it concise and direct

Tell YOUR story

Begin with the basics

It’s important to make it easier for people to contact you. By entering your phone number, location, and email address, you are making yourself more available. Also consider including a link to a meeting scheduler like Acuity or Calendly. Allow your prospects to choose the open time on your calendar that works best for their needs.

Add a Photo

You are the face of your own brand on LinkedIn. We recommend selecting a profile picture that will help set strong brand expectations. Wear a respectable outfit, be well groomed, and smile! Dress as though you are about to meet your most important client for a business meeting. Leverage your family and your pets in pictures. This is professional to us, but is also very personal to your Clients.

A Hearsay Advisor Cloud study concluded: “These posts had an average engagement rate of 48 percent, versus 42 percent for corporate posts”. By sharing insights into your personal life, you will start to build genuine trust between you and your prospects. They are likely to feel more comfortable to move forward with you as their Advisor.

Have a well written summary

Summaries are listed below your headshot and headline on LinkedIn and can be a powerful way to demonstrate your value through LinkedIn. You have 2,000 characters available in this space to explain Who you Are, What you Do, Who you Help and How you Help. This is your opportunity to provide reasons for potential viewers to continue, and include a call to action (CTA).

Consider including relevant topics for your business like “financial planning” or “retirement planning” in this section. Many potential clients use LinkedIn as a search engine.

Describe your experiences

This is where you will post your company name and job title. Provide a description of what you specialize in and any other relevant skills that differentiate your skillset. Include relevant past work experiences. Demonstrate your qualifications, successes and diverse background that make you a powerhouse in the financial services industry.

Instead of just including "financial advisor at xyz firm" TELL people EXACTLY how you can help them. If you target doctors, your headline could be "Helping new medical professionals manage their college debt while achieving their financial goals." This tells people who you are, the niches you serve, and how you can help!

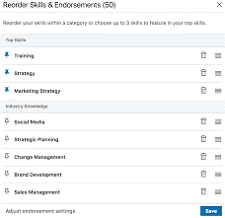

Add relevant skills

LinkedIn has a feature where you can add your skills that are unique and differentiating. Give your clients and prospects an understanding of your special skills that will specifically help deliver solutions to their needs through your Financial Planning process.

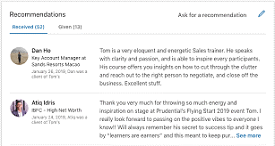

Recommendations:

IMPORTANT: Your Prospects are considering trusting you with their life savings, their future, and the future of their family’s well-being. Make sure to ask your Clients and Referral Sources to write testimonials for you. Provide them with templates / topics that reinforce your story, in order to make it easy for them.

You can also exchange writing recommendations with colleagues or other people in your network. These build social proof and trust among your audience.

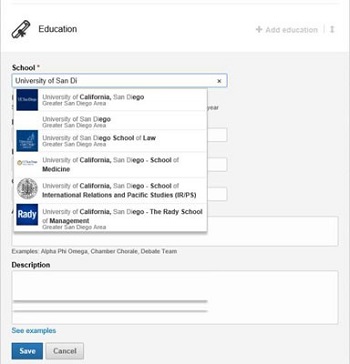

Education

Be sure to always include relevant designations, certifications, industry licenses and continuing education! People need confirmation that their Advisor is knowledgeable, secure, and is dedicated to improvement and continued success. Also be sure to add where you went to school, as this could help form connections with fellow alumni.

Start building a network

First step is always to add all your current clients. They will be delighted to have another connection with you. Next add your Prospects that you are nurturing into becoming Clients. After that, whenever you meet someone that might make a correct fit as a Client, invite them to join your LinkedIn network with a personalized message.

Groups and Hobbies

Being a member of LinkedIn groups provides an impression that you are connected, networked, and active in your areas of interest. It also telegraphs what your interests and personality traits are - people buy from people! Do you participate in non-profit groups? Rotary club? Coach your daughter’s baseball team? Church group, etc. This humanizes you, and as mentioned before this is personal to your Clients

Post content

This is arguably the second most important step. Once you have connected your profile to your sphere of influence, these people need to receive updates from you! Write your own content or leverage a company like Broadridge that offers services to provide updated FINRA reviewed content for you to post. Some services offer “Set and Forget” functionality, to automatically post relevant content.

LinkedIn content has a higher organic reach than other platforms like Facebook. Unlike Facebook, it’s possible to gain more traffic to content without paying for ads or "boosting" posts. Consider using relevant hashtags like "personal finance" or "financial education" to reach more defined audiences.

Keep it concise and direct:

Subconsciously, your brain will draw a parallel to your personality. If you are verbose and have a lot of clutter and information on your LinkedIn page, our brain patterns might associate you as being disorganized, difficult to deal with, complicated, etc.

Tell YOUR Story - this is a most difficult part:

If you remove your name; readers should still be able to know this LinkedIn profile is about you! You should not be able to substitute another Financial Advisors name, and have a similar profile.

BE UNIQUE. Remember to always use WIIFM! Let your viewers know “What’s In It For Me?”

Why did you become a FA? What make you different? Who are YOU (People buy from people)- be personal.; write your descriptive in the first person; Images and posts tell a story. (E.g. Tell a story about how you were a chubby kid, to lose weight you wrestled; after school you become an EMT and now you focus on Health Care professionals”). Or the experience your parent and family had and them struggling in retirement and trouble paying for LTC”

Start with the WHY: https://www.ted.com/talks/simon_sinek_how_great_leaders_inspire_action/transcript?language=en

Avoid cliché words and industry jargon:

Driven, Track Record, Experienced, Result Oriented, Highly, Leadership. Skilled. Passionate. Expert. Deep, Motivated. Creative. strategic, successful, Focused, specialized, extensive, Relationship (Use engage, advocate).

“my clients trust me” “I am people person”; “I am motivated” “Tailored approach” “My goal” “ “I develop deep relationships:… don’t start with “As a Financial Advisor, I help individuals, couples and families grow their assets for the long term.“- Who doesn’t do all this as an FA… or claim too?

Broadridge Financial Solutions 9/2020